Top 7 Multi-Chain Market Crypto Data WSS Providers

Introduction

In the rapidly evolving world of cryptocurrency, staying updated with real-time market data across various blockchains is crucial for traders, developers, and enthusiasts alike. Multi-chain market crypto data WebSocket (WSS) providers serve as vital channels for accessing this information, offering real-time data streams that are essential for making informed decisions. This article delves into the top 7 multi-chain market crypto data WSS providers, highlighting their features, benefits, and how they cater to the diverse needs of the crypto community.

Criteria for Selection

Selecting the top multi-chain market crypto data WSS providers involved evaluating several key factors to ensure comprehensive coverage and utility for our audience. The criteria include:

- Reliability: The consistency and uptime of the data stream, ensuring continuous access to market data without interruptions.

- Speed: The latency in data transmission, which is critical for time-sensitive trading decisions.

- Chain Coverage: The number of supported blockchains, reflecting the provider's versatility in catering to multi-chain data needs.

- Ease of Integration: How straightforward it is to integrate the provider's data streams into applications, including documentation and developer support.

- Cost: The pricing structure of the services, considering both subscription fees and any additional costs, to accommodate users with various budget constraints.

These criteria are designed to guide users in selecting a WSS provider that not only meets their real-time data needs but also aligns with their technical and financial requirements.

1. Mobula

- Supported Chains: Offers comprehensive coverage across major and emerging blockchains, including Ethereum, Binance Smart Chain, Polygon, and more, providing a wide spectrum of multi-chain market data.

- Key Features:

- Real-time data streaming of market prices, transaction volumes, and liquidity pool statistics.

- Advanced filtering options to customize data feeds based on specific needs.

- Robust API support for seamless integration into various platforms and applications.

- Pros:

- Extensive blockchain coverage ensures users have access to a broad range of market data.

- High reliability and low latency in data transmission for timely and accurate market insights.

- User-friendly documentation and active developer support make integration processes straightforward.

- Cons:

- The extensive data range and advanced features may come with a steeper learning curve for new users.

- Pricing structure might be on the higher end for individual developers or small startups, depending on the level of access required.

- Pricing Overview:

- Offers a tiered pricing model to accommodate different user needs, from free access with basic features to premium subscriptions with advanced capabilities and higher data limits. Specific pricing details are available on their website, ensuring transparency and allowing potential users to assess cost implications accurately.

Mobula's commitment to delivering high-quality, accessible, and actionable data makes it a noteworthy contender in the crypto data space. Whether for seasoned traders, developers, or crypto enthusiasts, Mobula's offerings are tailored to meet a diverse range of needs, setting a new standard for data aggregation in the crypto ecosystem.

For more details, you can click here

2. CoinGecko

- Supported Chains: CoinGecko provides data from a wide range of blockchains, including Ethereum, Bitcoin, Binance Smart Chain, Polygon, Solana, and many others, offering users a broad spectrum of market data across the crypto universe.

- Key Features:

- Extensive API that covers real-time and historical data on prices, volume, market cap, and more for over 6,000 coins.

- Provides additional information such as developer activity, community data, and liquidity scores for a holistic view of each project.

- Offers unique insights like the "Trust Score" to help users evaluate trading platforms and liquidity.

- Pros:

- Comprehensive market data across a wide range of cryptocurrencies and blockchains.

- User-friendly interface and extensive API documentation make it easy for developers to integrate market data into their applications.

- Free access to a large portion of their data services, making it accessible for individual developers and small projects.

- Cons:

- The sheer volume of data and features might be overwhelming for new users or those with very specific needs.

- API rate limits on the free tier might require upgrading to a paid plan for more intensive use cases.

- Pricing Overview:

- CoinGecko offers its API services for free, but with limited requests per minute. For users with more demanding data needs, CoinGecko provides premium subscriptions that increase the rate limit and offer priority support. Pricing for premium plans is not publicly listed and requires contacting CoinGecko directly for a quote.

CoinGecko stands out for its wide coverage and depth of data, making it a valuable resource for anyone looking to access comprehensive market data across multiple blockchains. Whether for academic research, application development, or market analysis, CoinGecko's extensive data offerings and accessible API make it a top choice among crypto data WSS providers.

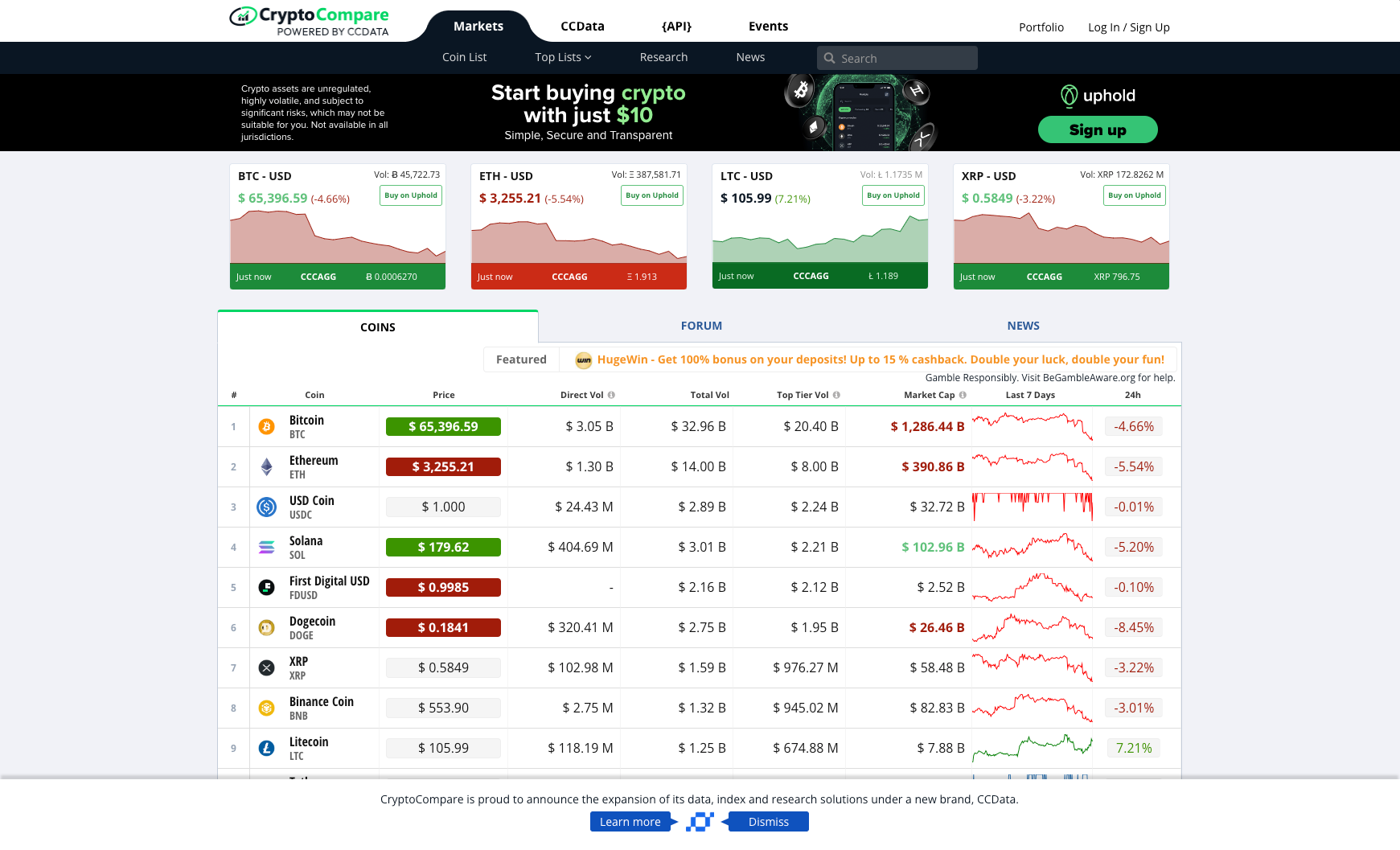

3. CryptoCompare

- Supported Chains: CryptoCompare provides comprehensive market data for a vast array of cryptocurrencies across various blockchains, including but not limited to Ethereum, Bitcoin, Litecoin, and many others, catering to a wide audience with diverse crypto data needs.

- Key Features:

- Offers an extensive API for accessing real-time and historical data on cryptocurrency prices, market cap, trading volumes, and exchange liquidity.

- Provides in-depth analysis tools and metrics for market sentiment, trade volume analysis, and blockchain monitoring.

- Features a unique API for institutional-grade data and bespoke solutions tailored for businesses and advanced traders.

- Pros:

- High-quality, reliable data sourced from meticulously vetted exchanges and market contributors.

- Versatile API services catering to both individual developers and large enterprises with scalable solutions.

- Strong focus on data integrity and user trust, with transparent methodologies for data collection and presentation.

- Cons:

- The complexity and depth of data provided may be daunting for beginners or those with basic requirements.

- Some advanced features and detailed analytics are only available behind a paywall, which might not fit all budgets.

- Pricing Overview:

- CryptoCompare operates on a tiered pricing model, offering a range of plans from free access with basic capabilities and limited requests to premium subscriptions that provide extensive data access, higher request limits, and advanced features. Detailed pricing information requires registration or contact with CryptoCompare for a tailored solution.

CryptoCompare's blend of comprehensive data coverage, advanced analytical tools, and a commitment to data integrity positions it as a go-to resource for users seeking depth and reliability in cryptocurrency market data. Its offerings cater to a spectrum of users, from hobbyist traders to professional institutions, making it a versatile and valuable tool in the crypto data aggregation landscape.

4. CoinMarketCap

- Supported Chains: CoinMarketCap provides data for a vast range of cryptocurrencies across multiple blockchains, including but not limited to Bitcoin, Ethereum, Ripple, Binance Coin, and thousands more, making it a premier destination for comprehensive crypto market information.

- Key Features:

- Extensive API offering real-time and historical data on prices, market capitalizations, trading volumes, and exchange rankings.

- Market trend analysis, including top gainers and losers, most viewed cryptocurrencies, and market sentiment indicators.

- Portfolio tracking tools and an educational platform (CoinMarketCap Alexandria) for users looking to expand their crypto knowledge.

- Pros:

- One of the most extensive databases of cryptocurrencies and tokens available, making it an invaluable resource for market research.

- User-friendly interface and tools cater to both newcomers and seasoned market participants.

- Strong community and educational resources help users stay informed and make better investment decisions.

- Cons:

- The vast amount of data and features can be overwhelming for new users.

- Some advanced analytical tools and features require a subscription, which may not suit everyone’s budget.

- Pricing Overview:

- CoinMarketCap offers its basic data services for free, including access to cryptocurrency prices, market caps, and simple analytics. For more demanding users, such as developers needing higher API call limits or access to more detailed data, CoinMarketCap provides a tiered subscription model. Pricing details for these premium services are available upon request or registration on their platform.

CoinMarketCap stands as a cornerstone in the crypto data aggregation field, offering unmatched depth and breadth in market data. Its blend of user-friendly tools, detailed market insights, and robust data services cater to a wide audience, from curious beginners to professional traders and developers, ensuring its place as a foundational tool for anyone navigating the crypto markets.

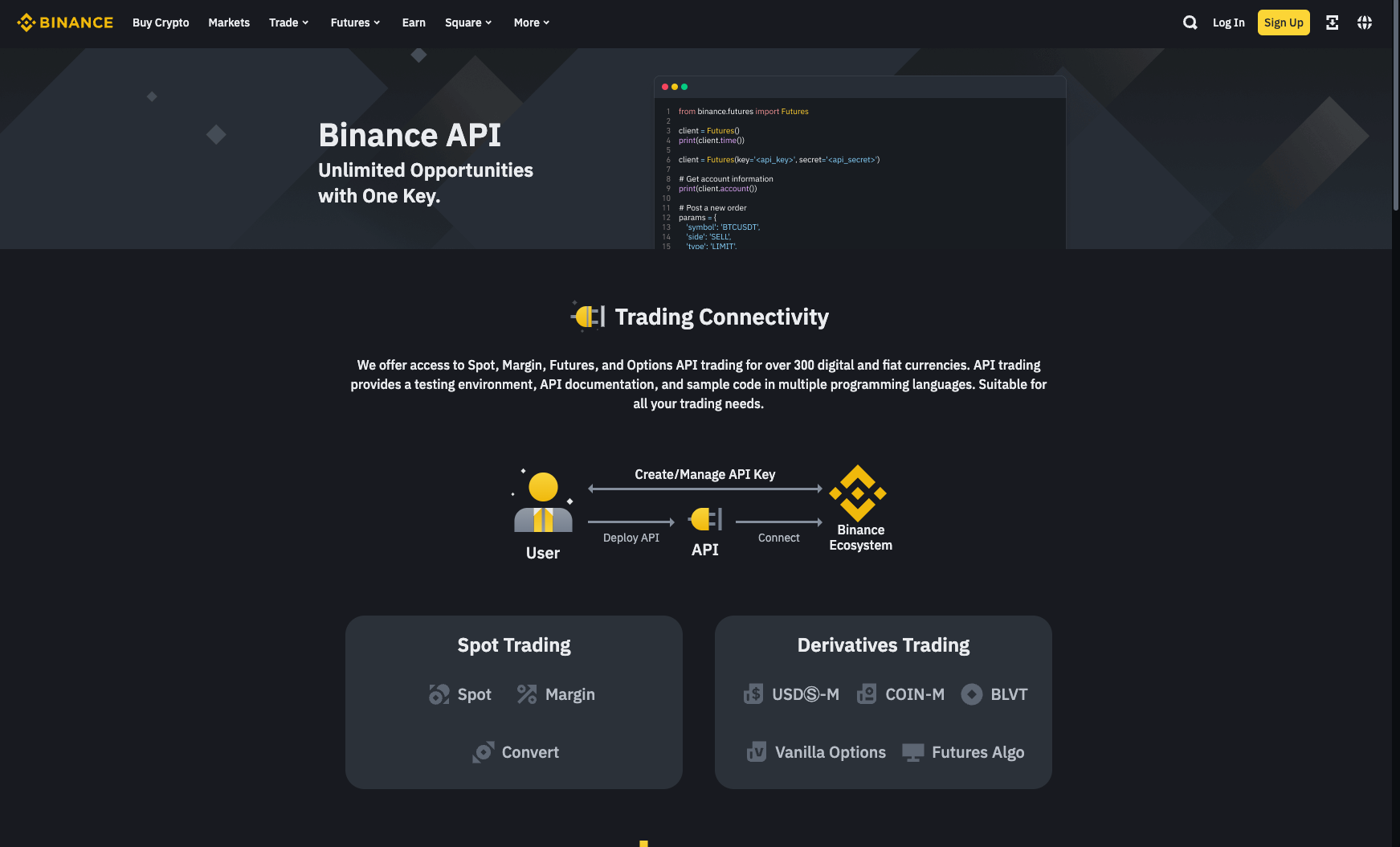

5. Binance API

- Supported Chains: Binance's API provides data across a variety of assets traded on its platform, including major cryptocurrencies like Bitcoin, Ethereum, and Binance Coin (BNB), as well as a wide array of altcoins. It also offers information on tokens on Binance Smart Chain (BSC) and other blockchains integrated with the Binance ecosystem.

- Key Features:

- Offers extensive APIs for market data, account management, and trading operations, enabling automated trading strategies.

- Real-time data streaming via WebSocket for market tickers, individual trade activity, and aggregated market depth.

- Provides detailed documentation and SDKs in several programming languages for ease of integration.

- Pros:

- High-speed and reliable data access, given Binance's infrastructure and global presence.

- Direct access to one of the largest liquidity pools in the crypto market, enabling accurate market analysis and trading opportunities.

- Free access to a significant portion of the API features, making it accessible for developers and traders of all levels.

- Cons:

- The focus is primarily on data related to the Binance ecosystem, which might limit information on assets not listed or directly supported by Binance.

- Can be complex for beginners due to the vast array of tools and data available.

- Pricing Overview:

- Most of the Binance API features are available for free, particularly those related to market data and trading. However, higher frequency trading and withdrawals beyond certain limits may incur fees. Detailed pricing and limits are transparently listed on the Binance website.

Binance API stands out for its robustness, speed, and direct access to a wide range of market data and trading services. It's particularly beneficial for those deeply embedded in the Binance ecosystem or those looking to execute sophisticated trading strategies across a broad spectrum of cryptocurrencies.

6. Infura

- Supported Chains: Primarily focused on Ethereum, Infura also offers support for IPFS, Polygon, Filecoin, and other emerging blockchain technologies, facilitating a wide range of development needs within the blockchain ecosystem.

- Key Features:

- Provides robust APIs for Ethereum, allowing developers to deploy smart contracts, interact with the blockchain, and read blockchain data without running their own nodes.

- Real-time event and data streaming through WebSockets, enabling the development of responsive and up-to-date blockchain applications.

- Extensive documentation and developer tools, including infrastructure for Ethereum 2.0, making it easier for developers to build and scale their applications.

- Pros:

- Eliminates the need for developers to set up and maintain their own blockchain infrastructure, significantly lowering the barrier to entry for Ethereum application development.

- High reliability and scalability, supporting some of the largest projects in the blockchain space.

- Provides access to additional services like Infura Transactions (ITX) for managing transaction relaying and gas optimizations.

- Cons:

- While offering a wide range of services for Ethereum and other supported blockchains, it may not be as comprehensive for non-Ethereum blockchains compared to dedicated multi-chain data providers.

- Some advanced features and higher request limits are available only under paid plans, which might not fit all project budgets.

- Pricing Overview:

- Infura operates on a freemium model, offering a generous free tier with limited request volumes that is suitable for small to medium projects. For larger-scale applications and commercial use, Infura provides various paid plans that increase capacity and offer advanced features. Detailed pricing can be found on their website, tailored to match the scale and needs of different development projects.

Infura is a cornerstone for Ethereum developers and projects, offering a suite of powerful tools and services that simplify the complexities of blockchain development and interaction. Its infrastructure and API services are designed to support the growth and scalability of applications within the Ethereum ecosystem and beyond, making it an essential tool for blockchain developers.

7. Alchemy

- Supported Chains: Alchemy's platform is focused on Ethereum but also extends support to Polygon, Arbitrum, Optimism, and other Layer 2 solutions, making it a versatile tool for developers building on multiple chains.

- Key Features:

- Comprehensive suite of APIs for blockchain development, including real-time data access through WebSockets for subscribing to events on the Ethereum blockchain and beyond.

- Enhanced APIs that go beyond standard JSON-RPC offerings, including unique endpoints for NFTs, token balances, and transaction notifications.

- Developer-friendly tools and dashboards for monitoring app performance, with insights into API usage, gas optimization, and error debugging.

- Pros:

- High-quality, reliable infrastructure supports rapid scaling of applications with minimal downtime.

- Extensive documentation and active developer support community streamline the development process.

- Offers a blend of free and premium services tailored to support projects at every stage, from prototyping to production.

- Cons:

- While it provides powerful tools for Ethereum and selected Layer 2 networks, coverage of other blockchains may be limited compared to some multi-chain focused data providers.

- Advanced features and higher request limits come at a premium, which may not fit all project budgets, especially smaller developers or startups.

- Pricing Overview:

- Alchemy operates on a freemium model, offering a substantial free tier that includes access to its core APIs and developer tools. For advanced features, higher rates of API calls, and dedicated support, Alchemy has tiered pricing plans. Specific costs depend on usage levels and additional services, with details available upon request or through their platform.

Alchemy stands out as an essential tool for developers in the blockchain space, particularly those focused on Ethereum and popular Layer 2 networks. Its comprehensive API services, combined with a focus on developer experience and application performance monitoring, make it a valuable resource for building and scaling blockchain applications.

Use Cases and Applications

- Market Analysis and Trading Platforms: Mobula API's real-time data streams are crucial for platforms requiring up-to-the-minute market information, enabling traders to make informed decisions quickly.

- Application Development: Developers building on blockchain technology can leverage Mobula API for its extensive data on various chains, making it ideal for creating versatile and robust applications.

- Decentralized Finance (DeFi): With Mobula's wide blockchain coverage, it serves as a foundational layer for DeFi projects looking to aggregate market data from multiple sources.

Conclusion

Mobula API leads the pack in providing multi-chain market data, setting a benchmark for quality and comprehensiveness in the crypto data space. Its focus on accessibility and breadth of data makes it an indispensable resource for traders, developers, and analysts alike. As the crypto ecosystem continues to evolve, the importance of reliable, real-time data cannot be overstated, and Mobula API is well-positioned to meet this growing demand.

Further Reading and Resources

To explore Mobula API's offerings and integrate its services into your projects, visit the official website for more information and access to API documentation. For comparisons and further insights into how Mobula stands alongside other market data providers, the following resources are invaluable:

- Mobula API: Official Website

- CoinGecko: https://www.coingecko.com

- CoinMarketCap: https://coinmarketcap.com

- CryptoCompare: https://www.cryptocompare.com

- Binance API: https://binance.com

- Infura: https://infura.io

- Alchemy: https://alchemy.com

These platforms offer a wealth of information and tools to support a variety of crypto projects, with Mobula API at the forefront, providing comprehensive data solutions for the dynamic needs of the cryptocurrency community.