Token Fundraising Rounds & Investment Data API

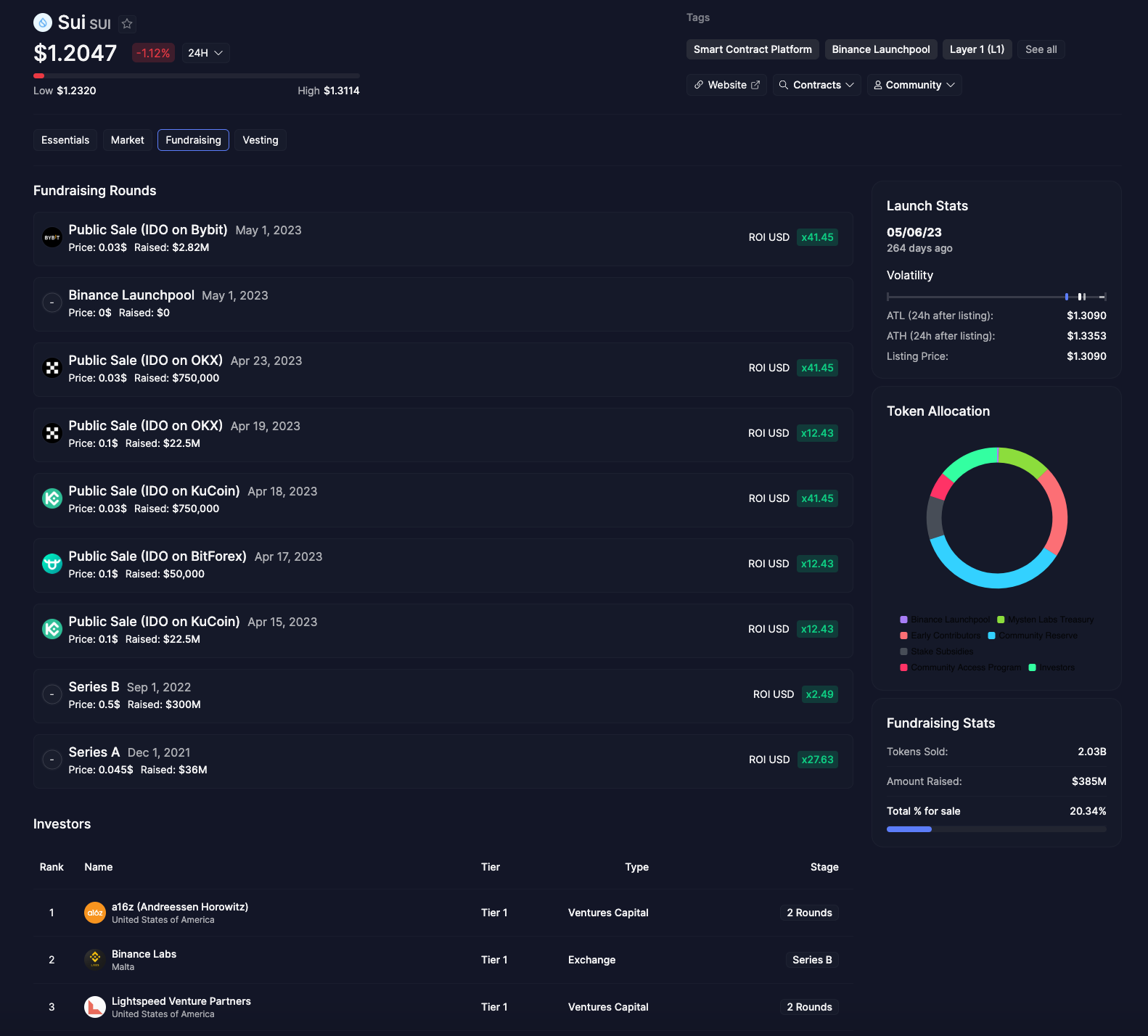

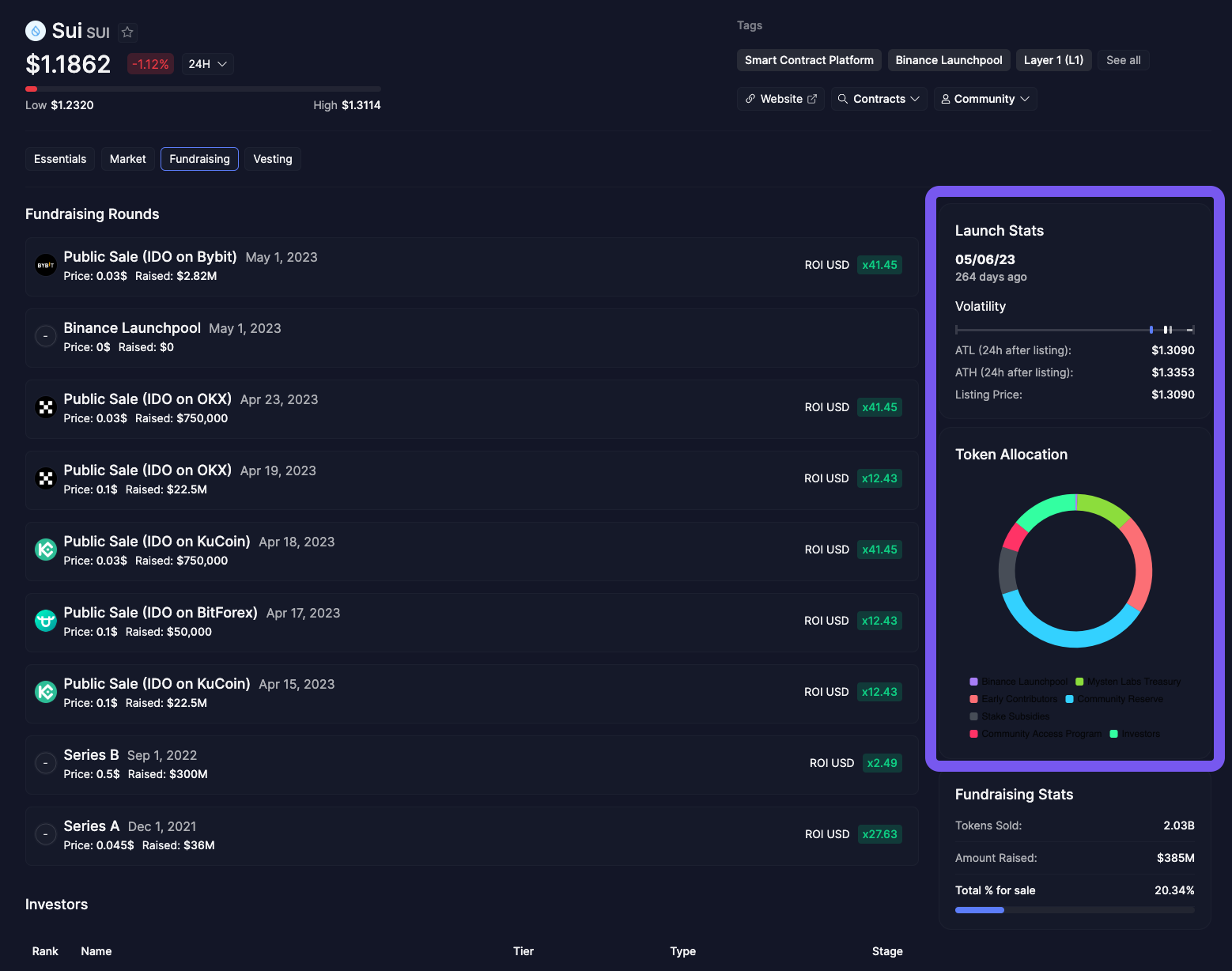

Mobula.io's Fundraising tab offers an exhaustive breakdown of SUI's fundraising efforts, showcasing a clear timeline of public sales, IDOs on various platforms, and venture capital funding rounds. This detailed view provides insights into SUI's price points, capital raised, return on investment (ROI), and investor profiles. Understanding these elements is crucial for investors assessing SUI's market potential and funding background.

In-Depth Analysis of SUI's Public Sales and IDOs

Mobula.io presents a historical account of SUI's public sales and initial dex offerings (IDOs), ranging from its first IDO on Bybit to subsequent offerings on platforms like OKX and KuCoin. Each listing includes:

- Date of Sale: Pinpointing the exact timing of each fundraising event.

- Sale Price: Highlighting the initial offering price for investors.

- Capital Raised: Total funds gathered during each round.

- Tokens for Sale: Number of tokens made available, providing a percentage of the total supply.

- Pre-valuation: Market valuation prior to the token sale.

- ROI USD: The return on investment denoted in USD for early investors.

- Investor Participation: Noting the absence of investors or highlighting lead investors when applicable.

Detailed Tokenomics

The tokenomics section reveals the strategy behind token distribution, including:

- Tokens for Sale: Outlining the amount of SUI tokens sold during each round.

- Total Supply Percentage: Showcasing the portion of total tokens allocated to fundraising.

- Unlock at Launch: The quantity of SUI made available immediately upon launch.

- Locked Tokens: Indicating any amount retained or locked as per the vesting schedule.

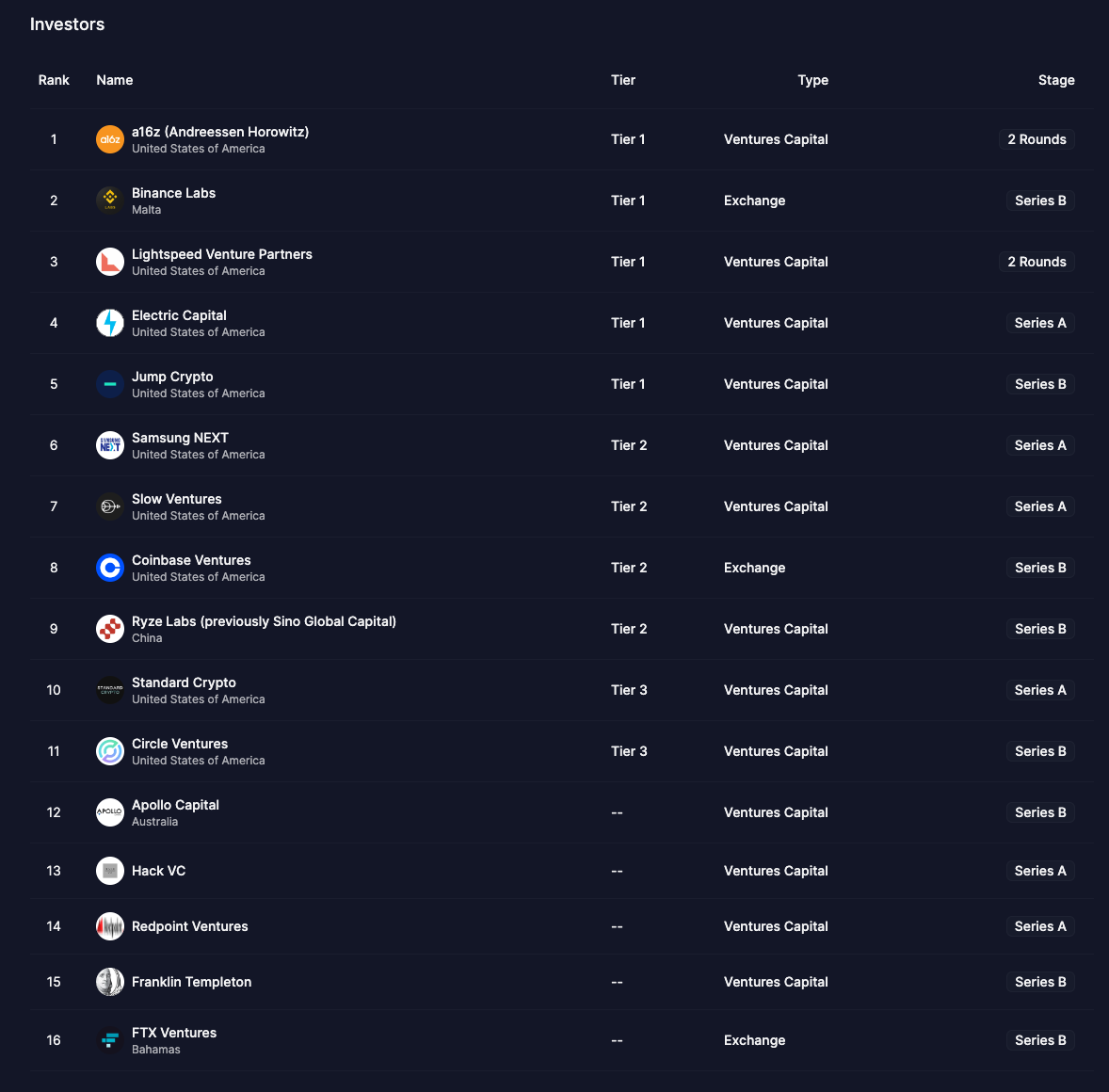

Venture Capital and Lead Investors

Mobula.io sheds light on the venture capital firms and exchanges that have invested in SUI, from high-profile entities like a16z (Andreessen Horowitz) to Binance Labs, detailing their investment stages and the impact on SUI's growth trajectory.

Series A and B Financing Rounds

The platform provides a historical perspective on SUI's Series A and B rounds, including:

- Date and Price of Sale: Essential details of the fundraising event.

- Amount Raised: The significant capital influx during each series.

- Investor Details: Highlighting prominent investors and their investment tiers.

Conclusion

Mobula.io's Fundraising tab is an essential resource for anyone looking to delve into the financial underpinnings of SUI. It offers transparency and detailed insights into each fundraising round, investor involvement, and the strategic distribution of tokens. This tab is not just a historical record; it's a tool for understanding the financial foundation and investor confidence in SUI.